Whether you work as part of a management leadership team for an insurance agency or you own an insurance agency, you carry tremendous responsibility on your shoulders. Even when hiring highly qualified agents, you still need to stay on top of things.

That’s just one aspect of working as an insurance agency leader. Even with hard-working agents, you need to make sure that every client receives superior service. That means they’re treated with respect, provided with information so they can select the correct policy, and given all applicable discounts to keep the premiums affordable.

Unfortunately, even the best leaders make mistakes. On the bright side, it’s possible to recover from some of these. However, certain errors can prove disastrous. So, the best plan is to identify the most common errors that agency leaders make and then avoid them at all costs.

The following are the 10 mistakes most often made by insurance agency leaders and owners and how to avoid them.

Spending Inadequate Time With People

For any insurance agency to grow and prosper, those in charge need to set an example. That includes spending quality time with clients, as well as with their agents. Make sure that you take the time to cover both professional and personal issues. Ask about their business, their families, their plans for the summer – remember, the goal is to form a bond with both your employees and your customers. People like to work for, and do business with, people that they like and trust.

Missing Opportunities to Develop Talent

Insurance agencies always try to hire the best insurance agents. Sometimes, that entails bringing someone on board who has years of experience and a ton of knowledge about the industry. Other times, it involves recognizing that someone new has incredible potential. All they need is a mentor.

You’ll even find hidden talent among your top agents. So, when an opportunity presents itself, take full advantage of it. Provide your team with the tools and support they need to succeed. After all, the better they do, the better the agency does.

Maintaining a “Closed Door Policy”

If you’re looking for a way to bring down office morale and turn clients away, then take an inaccessible approach to how you lead the agency. Well, you don’t want that. So, you need to be available and approachable to both your employees and your clients.

For the internal staff, you want them to know they can come to you any time to discuss anything. As for the clients, the focus is to make them feel that regardless of an issue, big or small, that you’re always accessible to them.

Failing to Provide Feedback

Insurance agency leaders who excel in their jobs understand the importance of providing their team with frequent feedback on their performance. Keep in mind that, at times, you’ll need to address a problem. However, you also want to point out when they excel. While constructive criticism will help them hone their skills, positive reinforcement will give them a sense of pride that encourages them to perform even better.

Ineffective Conflict Management

It doesn’t matter how many skilled agents work for your insurance agency; conflicts will arise. If not handled appropriately and effectively, a small issue could quickly turn into a serious situation. Within no time, the entire office would feel stressed and anxious.

Remember, an open-door policy combined with accessibility is a great way to prevent problems from occurring. However, the second you realize that something’s amiss, you need to take action, and not just any action—effective action. As an insurance agency leader, it’s up to you to get things out in the open and then to determine the right resolution.

Running a Stagnant Agency

With the insurance industry facing fierce competition, you can’t run an agency the same way you did 10 years ago. For one thing, that’ll prevent the agents from providing the clients with outstanding service. For another thing, it won’t take long before the members of your team look for work elsewhere.

Over the past several years, multiple things within this industry changed. As a prime example, agents now rely on advanced technology to maintain client records, schedule appointments, and even see trends that can help build a stronger agent/client relationship.

Now isn’t the time to cut corners. By investing in an insurance agency management system, you’ll quickly notice an improvement in the agents’ performance and the clients’ satisfaction.

Forgetting People Are Human

There’s a saying that “business is business,” but sometimes, it’s not. Yes, as an insurance agency leader, you need to run a tight ship, but at the same time, remember that every team member is a human being. As such, they have emotions triggered by good and bad experiences.

Sometimes, those experiences have to do with losing a client. You expect the agent to feel frustrated and disappointed. In your position, you don’t want to ignore those emotions. Rather, take time to listen to them and talk about what happened. Investing in the ups and downs of your staff will go a long way in helping them overcome challenges.

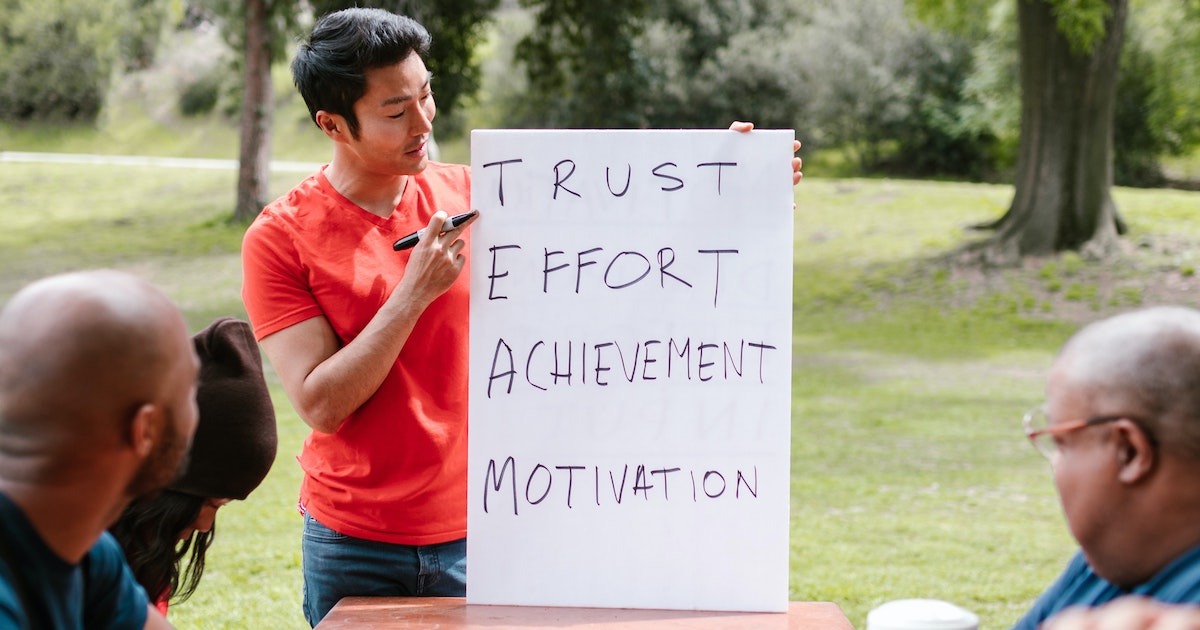

Failing to Motivate

If you want to see your agents go into overdrive, motivate them. Along with recognizing their incredible performance, let them attend a seminar, develop new talent, increase their pay, and so on. It’s amazing how insurance agents, and people in general, respond to the right motivation.

Not Encouraging Risk

Usually, the word “risk” relates to something bad or dangerous. However, there’s also such a thing as “good risk.” When selling insurance, you want your agents to take some risks. Otherwise, they’ll never beat the competition. It’s all about teaching them to push but without going outside of the safety zone. This is where you, as an insurance agency leader, can set attainable goals and boundaries.

Managing Without Leading

There’s a big difference between managing and leading. As a leader, you need to succeed at both. To manage your team, you need to organize, plan, control, and administer. To lead, you want to motivate, encourage, and inspire. If you can merge those two skills and apply them to your team, you’ll see a remarkable change in the agency.