We have added the ability to download Claims, view them, and enter them in manually at the client or policy level in JenesisNow.

Any questions or concerns? Email us at info@jenesissoftware.com!

We have added the ability to download Claims, view them, and enter them in manually at the client or policy level in JenesisNow.

Any questions or concerns? Email us at info@jenesissoftware.com!

https://www.youtube.com/watch?v=QlWjSioAQ8U

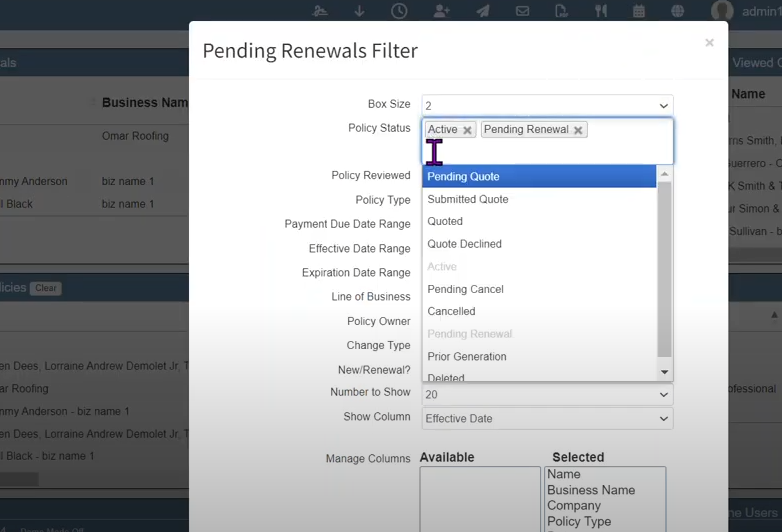

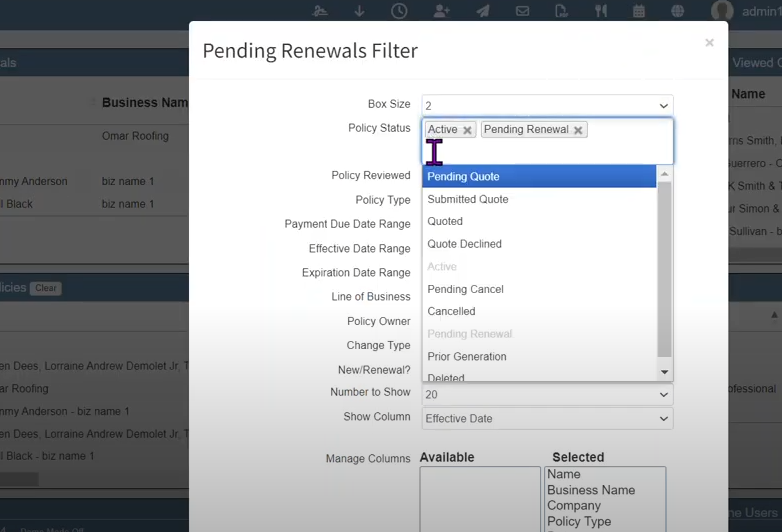

You are now able to change the setting for your Pending Renewal dashboard card to include any combination of policy status and not just active or pending renewal in JenesisNow.

Any questions or concerns? Email us at info@jenesissoftware.com!

In today’s digital landscape, your insurance agency website is often the first point of contact for potential clients. Ensuring that your website is both user-friendly and optimized for mobile devices is crucial for attracting and retaining customers. Here’s why it matters and how JenesisDigital can help.

A user-friendly website enhances the overall experience for visitors, making it easier for them to find the information they need and take desired actions, such as requesting a quote or contacting your agency. Key aspects of a user-friendly website include:

Intuitive Navigation: Visitors should be able to easily navigate through the site without confusion.

Fast Load Times: A slow website can frustrate users and lead to higher bounce rates.

Clear Call-to-Actions (CTAs): Buttons and links should be prominent and guide users toward conversions.

With the increasing use of smartphones, having a mobile-optimized insurance agency website is no longer optional. A mobile-friendly website includes:

Accessibility: Visitors can access your website from any device, including desktops, tablets, and phones, increasing the chances of engagement.

SEO Benefits: Search engines like Google prioritize mobile-friendly websites in their rankings.

Improved User Experience: A responsive design ensures your website looks great and functions well on all screen sizes.

Depending on the web package you choose, JenesisDigital offers mobile site features such as automatic mobile device detection, search engine-friendly links, mobile web statistics, contact/about us pages, click-to-map locations, click-to-call phone numbers, built-in forms, and more.

JenesisDigital specializes in creating websites tailored for independent insurance agencies, focusing on both user-friendliness and mobile optimization. Here are some reasons why you should choose to work with us:

Digital Handshake: Your website serves as the first impression for potential customers. JenesisDigital ensures it’s a positive one by crafting a visually appealing and easy-to-navigate site.

Affordable Solutions: We offer competitively priced packages designed specifically for insurance agencies.

Increased Client Engagement: Our designs focus on converting visitors into leads through streamlined online interactions and simplified quote retrieval processes.

Our website design portfolio is more than just a showcase. It’s a testament to the relationships we’ve built and the exceptional results we’ve delivered. With decades of steadfast partnership and experience in the insurance industry, we’ve mastered the art of creating websites that not only look stunning but also drive business. Our portfolio showcases a diverse range of insurance and title agencies just like yours.By partnering with JenesisDigital, you can expect an insurance agency website that not only attracts visitors but also converts them into loyal clients. We leverage over 30 years of industry expertise to ensure that your site meets all the necessary standards to stand out in the digital space. Discover the difference a professionally designed, user-friendly, and mobile-optimized website can make for your insurance agency.

Schedule your free strategy session with JenesisDigital today, and take the first step towards elevating your online presence.